In 2024, Companies Have to Share More Information with the Government

Posted February 9, 2024 by in Articles & Publications, BizLaw 101 BlogWith the rise in financial crimes and money laundering and the increasingly problematic use of “shell companies” to commit these crimes and wrongdoings, the Government decided to take action. In 2021, Congress passed legislation which included the Corporate Transparency Act (“CTA”), which requires certain business entities to file a Beneficial Owner Information Report (“BOI Report(s)”).

I. WHAT COMPANIES MUST REPORT?

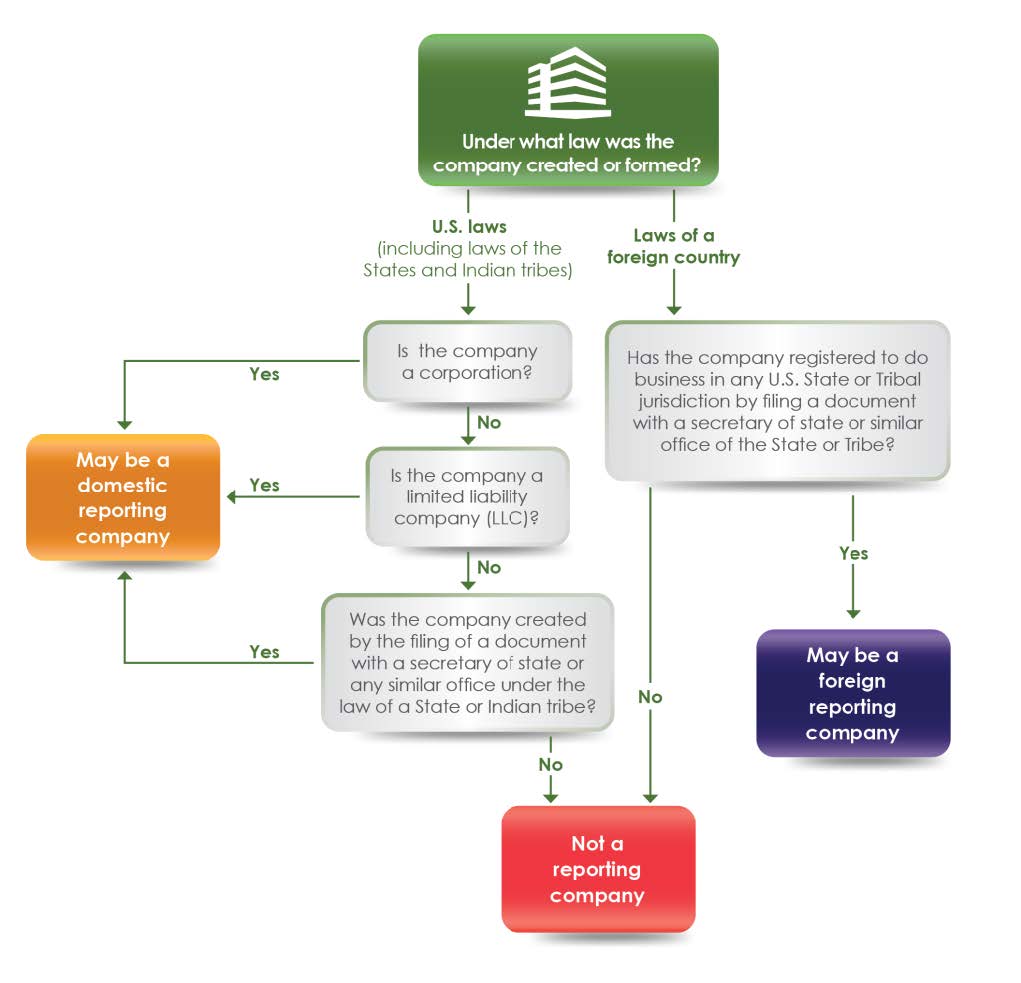

The Treasury Department estimates that more than 32 million entities will be required to disclose information about their owners. Called “Reporting Companies,” these include a wide range of companies -- corporations, limited liability companies, limited partnerships, limited liability partnerships, any similar entity created by filing a document with a state’s secretary of state (or similar office), or an entity formed under the law of a foreign country and registered to do business in the United States by the filing of documents with a secretary of a state. This is an expansive definition and may include non-traditional business entities, including Community Associations.

Entities that are exempt from the new reporting requirement include governmental authorities, banks and credit unions, money service businesses, investment advisors, securities brokers and dealers, tax exempt entities (under Section 501(c) of the Internal Revenue Code), insurance companies and state-licensed insurance producers, pooled investment vehicles, public utilities, inactive entities, accounting firms, certain large operating companies, entities that are required to report to the Securities and Exchange Commission, sole proprietorships, trusts not registered with a Secretary of State, general partnerships not registered with a Secretary of State, and other entities which do not otherwise tend to obscure the identity of its beneficial owners.

The Treasury Department has provided a chart to identify, in a simple format, whether companies are required to report. While helpful, it does not cover every circumstance for determining applicability of the law’s new reporting requirements.

II. WHO IS A BENEFICIAL OWNER AND WHAT DO THEY NEED TO REPORT?

Under the new legislation, every covered entity must file an initial report that includes:

- The full name of the reporting company,

- Any trade name(s) or D/B/A name(s) used by, or related to, the reporting company,

- Current address, including the State,

- IRS Taxpayer Identification Number (TIN), including the applicable Employer Identification Number(s) (EIN); AND

- Beneficial Owner Information

A Beneficial Owner is anyone who holds at least 25% interest in the entity or who exercises substantial control over the entity.

An individual exercises substantial control over an entity if that person:

- Is a senior officer,

- Has authority to appoint or remove any senior officer, or

- Has any other form of substantial control over the entity.

This is a broad classification which could potentially cover several different individuals within one single entity.

Each Beneficial Owner must disclose their:

- Full Legal Name,

- Date of Birth,

- Complete Current Residential Address,

- Unique ID Number from government issued identification and Issuing Jurisdiction (number reflected on a valid passport or state-issued identification device), AND

- Copy of document which reflects the Unique ID Number (e.g., passport, driver’s license)

III. WHO IS AN “APPLICANT” AND WHAT MUST THEY REPORT?

All Reporting Companies formed or registered after January 1, 2024, must also disclose the same information about the Reporting Company’s Applicant as they disclose for the Beneficial Owners.

Under the CTA, an “Applicant” is the individual or company who directly files the document that creates or first registers the reporting company. In the event that multiple individuals were responsible for filing the document that forms or registers the reporting company, the Applicant is the individual who is primarily responsible.

Oftentimes, a third party, such as a lawyer or other corporate entity, will have created the entity by filing the appropriate documents with a Secretary of State. In this case, the address for the Applicant should be the office address. If formed by an individual, the address should be their personal residential address.

IV. TIMING AND PENALTIES

Under the CTA, there are time periods in which BOI Reports must be filed. For all business entities formed before January 1, 2024, the initial BOI Report must be filed by the end of the year.

New business entities formed on or after January 1, 2024 must file their initial BOI Report within 30 days of registration of the entity with a Secretary of State or other similar office. However, for the first year that this statute is in effect (meaning 2024), newly formed entities can receive an extension of 90 days to file their initial BOI Report.

Additionally, any updates or corrections to beneficial ownership information that was previously filed in a BOI Report must be filed within 30 days.

Failure to comply with the requirements of the CTA, including the timely filing of BOI Reports, carries severe civil and potentially criminal penalties. A failure to file or a filing deemed fraudulent can result in monetary civil fines of $500 per day for as long as the BOI Report remains unfiled or fraudulent. However, criminal charges can also be brought against an individual who fails to file a BOI Report, or files a fraudulent BOI Report, and can result in a maximum fine of $10,000.00 and up to two (2) years of incarceration.

This blog was authored by Donald J. Carswell, Jr., Esq. If you have questions about the Corporate Transparency Act, the attorneys at Press, Dozier & Hamelburg, LLC, have extensive experience providing legal counsel to individuals, businesses, as well as non-profit and community associations, and are ready to help you, your business, or association navigate these new requirements.